What is Statistical Arbitrage?

Statistical arbitrage is not traditional arbitrage, which involves exploiting price differences of the same asset across different markets. Instead, it leverages statistical models to infer a trading opportunity. The premise is that two or more assets have a historical correlation, and if that relationship deviates, there may be an opportunity to buy the undervalued asset and sell the overvalued one, expecting their prices to revert to the mean.

This strategy is data-driven and relies heavily on historical price data, econometric modeling, and high-frequency trading (HFT) systems. Traders who engage in statistical arbitrage usually use a market-neutral approach, meaning they attempt to eliminate exposure to market-wide movements by simultaneously holding long and short positions of equal value.

How Does It Work?

The basic mechanics of statistical arbitrage follow a series of steps:

- Pair Selection: Traders identify two or more securities with a strong historical correlation. These can be stocks in the same industry, ETFs, or other assets that tend to move in tandem.

- Model Development: Using statistical techniques such as linear regression, cointegration, or machine learning, traders model the relationship between the assets. A common approach is the pairs trading strategy, where a “spread” between two assets is calculated.

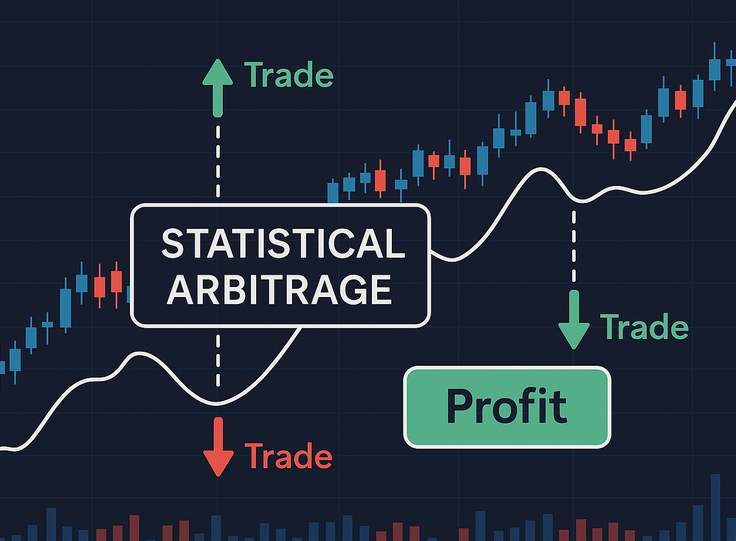

- Signal Generation: When the spread between the prices deviates significantly from the historical mean beyond a predefined threshold, a trading signal is generated. The assumption is that this deviation is temporary.

- Trade Execution: The trader goes long on the undervalued asset and short on the overvalued asset, expecting the prices to revert to their historical relationship.

- Exit Strategy: Once the spread reverts to the mean or a profit target is reached, the positions are closed.

Example of Statistical Arbitrage

Consider two oil and gas companies, ExxonMobil (XOM) and Chevron (CVX), which tend to have correlated stock movements due to similar market exposures. Historically, if their price ratio averages 1.05 (i.e., XOM is typically priced 5% higher than CVX), and suddenly CVX jumps, narrowing or reversing this gap, the trader may short CVX and go long XOM. If the prices revert to their historical relationship, the strategy yields a profit.

Is It Profitable?

Statistical arbitrage has been profitable historically, particularly for hedge funds and proprietary trading firms with access to advanced technology and large data sets. The strategy thrives in environments with high liquidity, volatility, and small inefficiencies that can be exploited quickly.

However, its profitability has declined over time as markets have become more efficient and competition among quantitative traders has intensified. The margins are now thinner, and profitability often depends on speed, model sophistication, and access to capital.

Moreover, it remains a relative-value strategy—profits are made not from absolute price movements, but from price discrepancies—making it attractive in both bullish and bearish market conditions.

Risks Involved

Despite its appeal, statistical arbitrage is not without risks:

- Model Risk: If the statistical model is flawed or based on incorrect assumptions, it can lead to significant losses.

- Execution Risk: Since this strategy often relies on high-frequency trading, delays in execution can erode profit margins.

- Overfitting: A common pitfall in model development where a strategy performs well on historical data but fails in live markets.

- Correlation Breakdown: Relationships between assets can change due to structural market shifts, rendering previously profitable strategies ineffective.

- Leverage Risk: Many statistical arbitrage strategies use leverage to amplify returns, which also increases the potential for losses.

Conclusion

Statistical arbitrage is a data-driven, market-neutral trading strategy that capitalizes on temporary mispricings between correlated assets. While potentially profitable, especially for institutions with advanced infrastructure, it carries inherent risks related to modeling accuracy, market changes, and execution. For individual traders, engaging in stat arb requires a deep understanding of statistics, strong programming skills, and robust risk management practices.