Why is Forex Correlation Important?

- Risk Management: Trading highly correlated pairs in the same direction increases exposure. If both go against you, your losses double.

- Hedging: You can reduce risk by taking opposite positions in negatively correlated pairs.

- Diversification: Low or non-correlated pairs reduce overexposure to the same market move.

- Strategy Confirmation: Correlated pairs moving in the same direction can confirm trend strength.

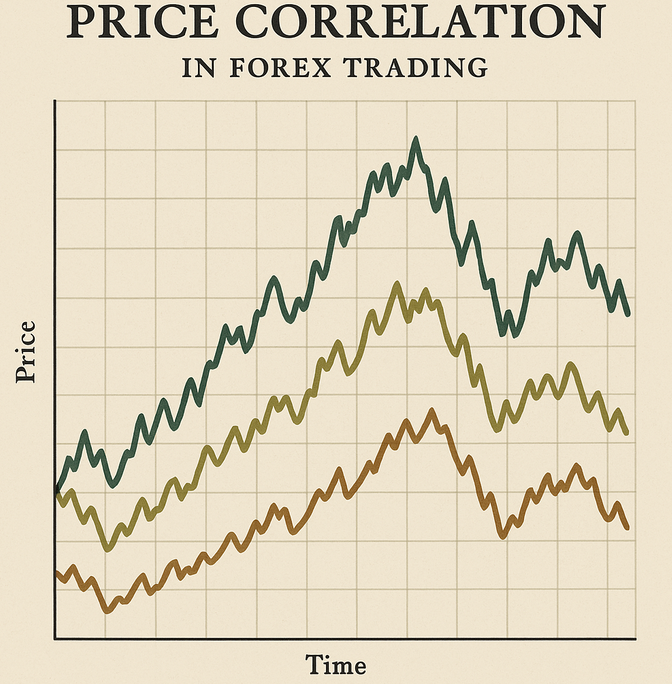

How Price Correlation Can Be Used

Below is a table showing the price correlation matrix for the Major Forex Pairs. Correlation values range from -1 to 1:

- 1 = perfect positive correlation (move together)

- 0 = no correlation

- -1 = perfect negative correlation (move in opposite directions)

We'll use the Major Forex Pairs:

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CHF

- AUD/USD

- NZD/USD

- USD/CAD

Here’s a sample correlation table based on historical daily data (correlations may vary slightly depending on timeframes and market conditions):

Example of Using Correlation in a Strategy

Let’s observe two (2) examples for the above table data.

One with Negative Correlation and one with Positive Correlation:

- EUR/USD and USD/CHF → High negative correlation (-0.95)

Example Strategy: Hedging via Inverse Correlation

- You believe the USD will weaken, so you go long EUR/USD.

- Because EUR/USD and USD/CHF move in opposite directions, you go short USD/CHF at the same time.

- If the USD weakens:

- EUR/USD rises → profit

- USD/CHF falls → profit

- If the USD strengthens (your initial thesis was wrong):

- EUR/USD falls → loss

- USD/CHF rises → profit

- One loss is partially or fully offset by the other gain = reduced risk exposure.

- AUD/USD and NZD/USD → Strong positive correlation (0.90)

Example Strategy: Trend Confirmation

- AUD/USD breaks a key resistance level and starts trending up.

- You check NZD/USD — it's also breaking resistance and trending up.

- High correlation and aligned breakout add confidence to your long trade on AUD/USD.

- Alternatively, you can split your position between both for more balanced exposure.

Final Thoughts

Correlation is not static - it changes over time based on:

- Economic events

- Interest rate decisions

- Geopolitical changes

Pro tip: Use correlation in combo with technical analysis, fundamentals, and news to improve edge - don't rely on it in isolation.