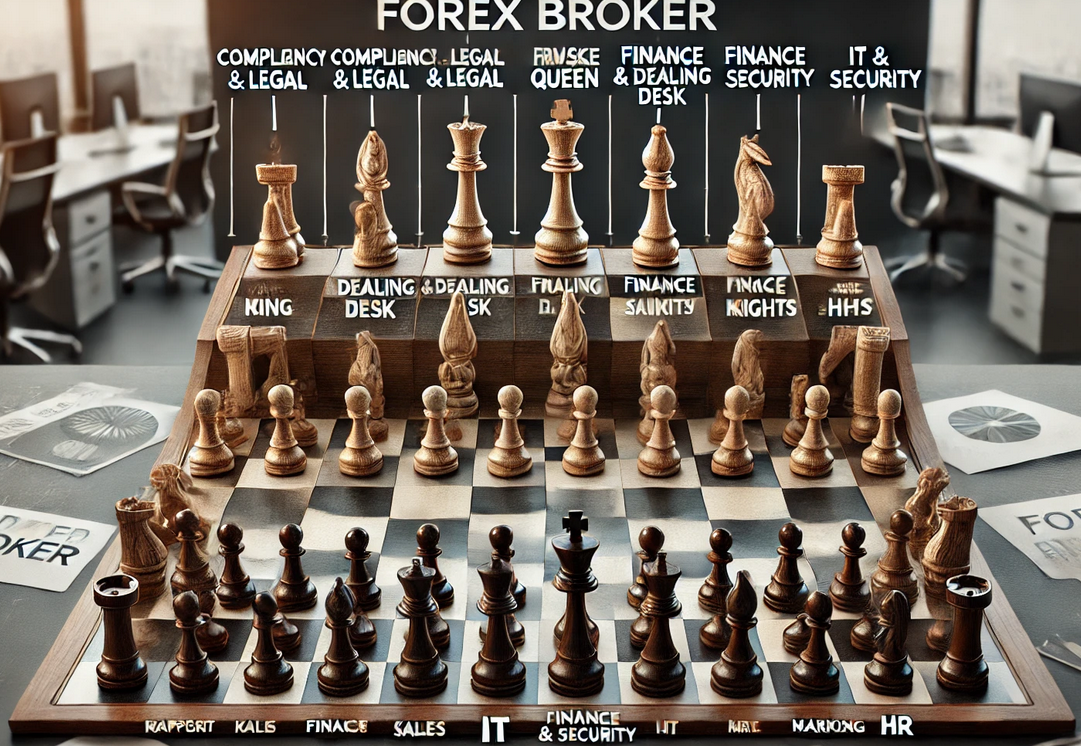

1. Compliance & Legal Department

Responsibilities:

- Regulatory Compliance: Ensures the company operates within the rules set by financial regulators (e.g., FCA, CySEC, ASIC).

- Licensing & Reporting: Handles applications for new licenses and ongoing regulatory reporting.

- AML & KYC Procedures: Implements and enforces policies to prevent money laundering and fraud.

- Client & Transaction Monitoring: Monitors transactions to detect suspicious activities.

- Contract & Legal Documentation: Drafts and reviews contracts, agreements, and terms of service.

- Regulatory Communication: Acts as the point of contact between the broker and financial regulators.

2. Risk Management Department

Responsibilities:

- Trade Exposure Management: Analyzes and manages risks associated with client trades.

- Liquidity Risk Control: Ensures there is enough liquidity to meet client withdrawals and trade settlements.

- Market Risk Analysis: Assesses volatility and adjusts risk strategies accordingly.

- Leverage & Margin Management: Monitors client leverage levels to mitigate excessive risk.

- Internal Risk Policies: Develops frameworks to minimize operational and financial risks.

3. Finance & Accounting Department

Responsibilities:

- Financial Reporting: Prepares financial statements and regulatory reports.

- Client Fund Segregation: Ensures compliance with regulations requiring separation of client and company funds.

- Audit & Tax Compliance: Manages internal audits and ensures tax obligations are met.

- Payment Processing: Oversees deposits, withdrawals, and payment service provider integrations.

- Budgeting & Cost Management: Ensures operational expenses align with business goals.

4. Trading & Dealing Desk

Responsibilities:

- Trade Execution: Ensures client orders are executed efficiently with minimal slippage.

- Liquidity Provider Management: Connects with LPs to ensure competitive spreads and deep liquidity.

- Market Making: For B-book brokers, manages risk by taking the opposite side of trades.

- Hedging & Exposure Management: Monitors open positions and hedges risk when necessary.

- Price Feed Monitoring: Ensures accurate price feeds and prevents pricing errors or manipulation.

5. IT & Security Department

Responsibilities:

- Trading Platform Maintenance: Supports platforms like MT4, MT5, cTrader, and proprietary systems.

- Cybersecurity & Data Protection: Implements security measures to protect client data and funds.

- Server Management & Uptime: Ensures servers run 24/7 to maintain trading availability.

- API & Software Development: Develops and maintains APIs for integrations with third-party services.

- Disaster Recovery & Backup: Implements backup strategies in case of system failures.

6. Customer Support & Client Relations

Responsibilities:

- 24/7 Client Assistance: Provides support via email, chat, and phone in multiple languages.

- Account Verification & Onboarding: Guides clients through KYC and document submission processes.

- Technical & Trading Assistance: Helps clients with platform usage, execution issues, and withdrawals.

- Complaint Handling: Resolves disputes fairly and efficiently.

- Client Education & Training: Provides resources and training for traders.

7. Sales & Business Development

Responsibilities:

- Client Acquisition: Generates leads and converts them into active traders.

- Affiliate & IB Management: Builds relationships with Introducing Brokers and affiliates.

- Partnership Development: Expands business through institutional partnerships and liquidity providers.

- Market Expansion: Identifies and enters new markets while ensuring regulatory compliance.

8. Marketing & Branding

Responsibilities:

- Advertising & Campaigns: Runs digital and traditional marketing campaigns.

- SEO & Content Creation: Ensures website and blog content rank well in search engines.

- Social Media Management: Engages with traders through Twitter, Telegram, and other channels.

- Educational Resources: Creates webinars, eBooks, and video tutorials for traders.

- Brand Awareness: Develops a strong brand presence in the forex industry.

9. Back Office & Operations

Responsibilities:

- Account Management: Handles deposits, withdrawals, and reconciliation of funds.

- Document Processing: Reviews client documentation for compliance with KYC and AML.

- Transaction Monitoring: Detects and resolves payment and account discrepancies.

- Internal Reporting: Provides reports on operational efficiency and trading activity.

- Support for Other Departments: Assists compliance, finance, and IT teams with administrative tasks.

10. Human Resources (HR)

Responsibilities:

- Recruitment & Hiring: Finds and hires skilled employees for all departments.

- Employee Training & Development: Conducts training on compliance, trading, and customer service.

- Performance Management: Evaluates employee performance and implements retention strategies.

- Company Culture & Policies: Develops HR policies, code of conduct, and workplace ethics.

- Payroll & Benefits Management: Manages employee salaries, bonuses, and benefits.

The above company structure ensures that a forex broker operates efficiently while meeting regulatory requirements. In addition, depending on the broker's size and regulatory jurisdiction, some extra specialized departments (e.g., Liquidity Management, Institutional Sales) may be required.