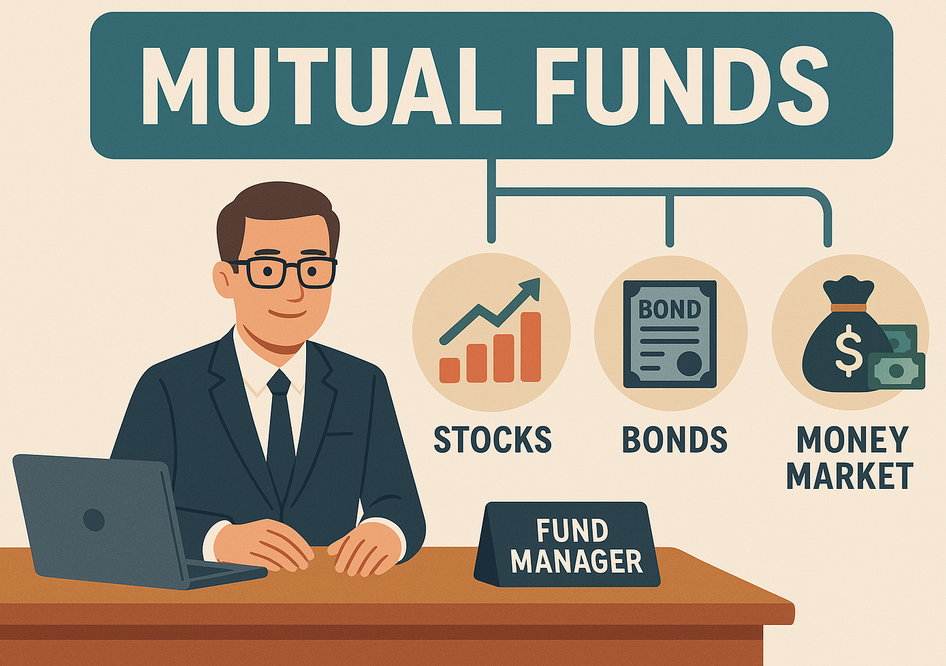

These funds are managed by professional fund managers who make investment decisions on behalf of investors, aiming to achieve the fund’s objectives—such as growth, income, or a combination of both. Mutual funds offer investors a way to access diversified and professionally managed portfolios without the need to manage individual securities themselves.

Purpose of Mutual Funds

The primary purpose of mutual funds is to provide investors with an efficient, cost-effective, and diversified way to invest in financial markets. The key objectives include:

- Diversification – By spreading investments across multiple assets, mutual funds help reduce risk compared to investing in a single stock or bond.

- Professional Management – Fund managers conduct market research, select investments, and monitor performance to maximize returns.

- Liquidity – Investors can buy or sell mutual fund shares relatively easily, making them a more flexible investment option compared to direct stock investments.

- Affordability – Investors can participate with relatively small amounts of money, making mutual funds accessible to individuals who may not have large capital to invest in individual stocks or bonds.

- Convenience – Mutual funds simplify investing by eliminating the need for investors to research and manage a portfolio actively.

Suitable Investors for Mutual Funds

Mutual funds are suitable for a broad range of investors, from beginners to experienced individuals. Here are some investor profiles who may benefit from mutual funds:

- New Investors – Those with limited market knowledge who want professional management and diversification.

- Busy Professionals – Individuals who lack the time to analyze and manage their investments but seek market exposure.

- Retirement Planners – Investors looking for long-term wealth accumulation through systematic investment plans (SIPs) in mutual funds.

- Risk-Averse Investors – Those seeking lower risk can opt for bond or money market mutual funds.

- Aggressive Investors – Investors who prefer higher risk in exchange for potentially higher returns can invest in equity mutual funds.

Factors Affecting Mutual Fund Returns

Several factors influence the performance of mutual funds, including:

- Market Conditions – The overall performance of stock and bond markets directly affects mutual fund returns.

- Interest Rates – Rising interest rates can negatively impact bond mutual funds, whereas declining rates may boost bond fund prices.

- Economic Factors – Inflation, GDP growth, employment rates, and monetary policies impact mutual fund returns.

- Fund Manager’s Expertise – The skill and experience of the fund manager play a crucial role in determining the performance of actively managed mutual funds.

- Expense Ratios and Fees – High management fees can reduce net returns, so it’s important to consider the expense ratio when investing.

- Exchange Rate Fluctuations – For international mutual funds, currency exchange rates can impact returns, especially in foreign investments.

- Sector Performance – Funds heavily invested in a particular sector (e.g., technology or healthcare) may be affected by sector-specific trends.

Regulations and Restrictions on Mutual Funds Across Regions

Mutual funds are subject to different regulatory frameworks depending on the region:

- United States – The U.S. Securities and Exchange Commission (SEC) regulates mutual funds under the Investment Company Act of 1940. Funds must register with the SEC, provide transparency, and adhere to strict compliance guidelines.

- Europe – The European Union regulates mutual funds through the Undertakings for Collective Investment in Transferable Securities (UCITS) framework, ensuring investor protection and standardized regulations across member states.

- Asia – Regulations vary by country. For example, in India, the Securities and Exchange Board of India (SEBI) oversees mutual funds, while in Japan, the Financial Services Agency (FSA) regulates funds.

- Australia – The Australian Securities and Investments Commission (ASIC) supervises mutual funds, ensuring they comply with strict financial disclosure and governance standards.

Conclusion

Mutual funds offer an excellent investment vehicle for individuals seeking diversification, professional management, and long-term wealth accumulation. Their suitability depends on an investor’s financial goals, risk tolerance, and market understanding. However, returns can be influenced by various economic and market factors. Regulatory frameworks differ across regions, ensuring investor protection and fund compliance. Before investing, individuals should research mutual fund types, fees, and performance history to align with their financial objectives.