Investors and traders closely monitor this ratio as it can offer insights into market trends, potential investment opportunities, and broader economic conditions.

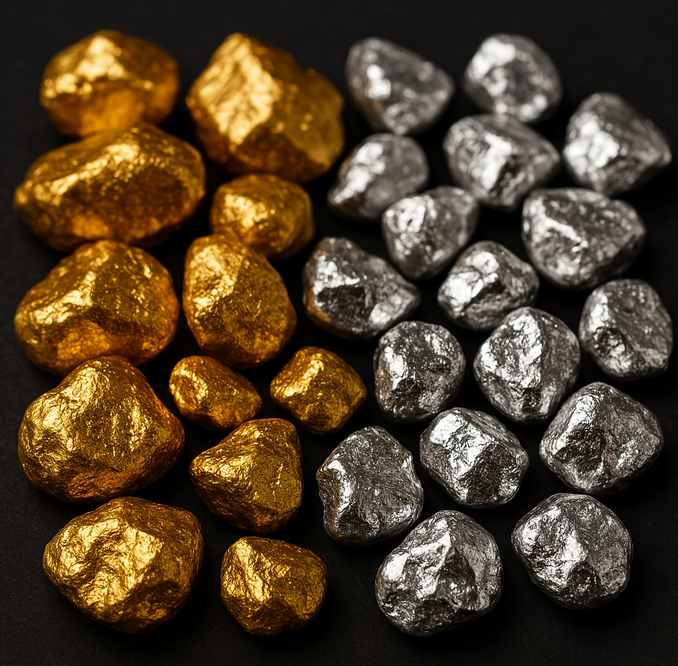

Understanding the Gold/Silver Ratio

The gold/silver ratio is calculated using the simple formula:

For example, if gold is trading at $2,000 per ounce and silver at $25 per ounce, the ratio would be:

This means that one ounce of gold is worth 80 ounces of silver. Historically, this ratio has fluctuated significantly, often ranging between 40 and 90. It is influenced by multiple factors, including economic conditions, inflation, monetary policies, and supply-demand dynamics.

Is the Gold/Silver Ratio a Reliable Investment Indicator?

Investors use the gold/silver ratio as a potential indicator to determine whether gold or silver is undervalued or overvalued relative to each other.

- High Ratio (Above Historical Average): When the ratio is high, it suggests that gold is relatively expensive compared to silver. Some investors interpret this as a buying opportunity for silver, assuming that the ratio will eventually revert to its historical mean.

- Low Ratio (Below Historical Average): When the ratio is low, it implies that silver is expensive relative to gold. This might encourage investors to buy gold instead, expecting the ratio to rise again.

However, while the gold/silver ratio can provide useful insights, it should not be the sole determinant for investment decisions. Market conditions, geopolitical risks, inflationary trends, and industrial demand for silver (especially in sectors like electronics and renewable energy) must also be considered.

Historical Trends and Today’s Ratio

Over the last two decades, the gold/silver ratio has experienced substantial fluctuations. During the 2008 financial crisis, the ratio spiked above 80 as investors sought the safety of gold. In 2011, silver’s price surged due to industrial demand, bringing the ratio down to around 40. More recently, in March 2020, the ratio reached an all-time high of approximately 125 due to economic uncertainties caused by the COVID-19 pandemic.

As of today, the gold/silver ratio stands at approximately (latest value needed). This figure suggests that gold is (overvalued/undervalued) relative to silver, potentially indicating a (buying/selling) opportunity for investors depending on their market outlook.

Conclusion: Should You Invest in Gold or Silver?

The gold/silver ratio is a valuable tool for analyzing market trends and identifying potential investment opportunities. However, it should not be used in isolation. Investors must consider broader economic indicators, supply-demand fundamentals, and their own risk tolerance before making investment decisions.

For those seeking long-term stability, gold is often viewed as a safe-haven asset. Silver, on the other hand, tends to have higher volatility but also offers potential for greater returns due to its industrial applications. Understanding the gold/silver ratio alongside other market factors can help investors make more informed decisions in the precious metals market.